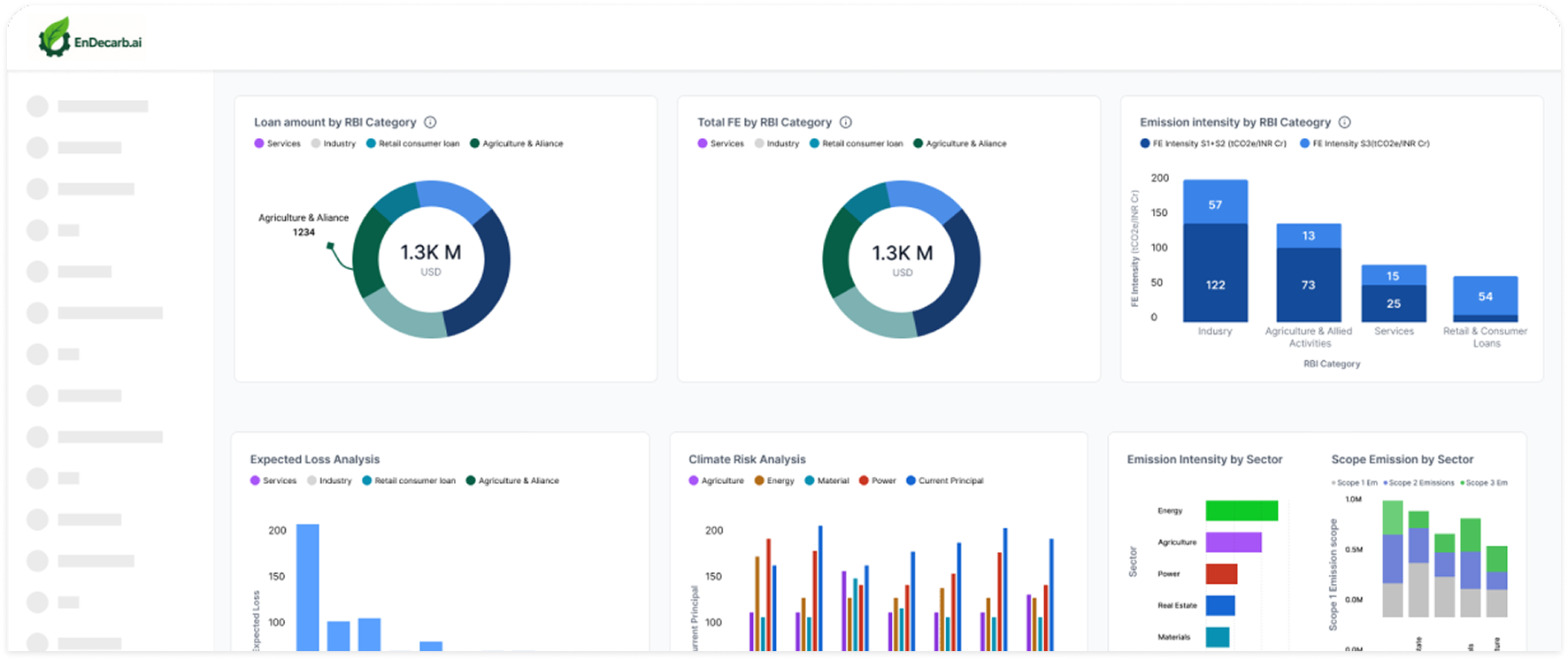

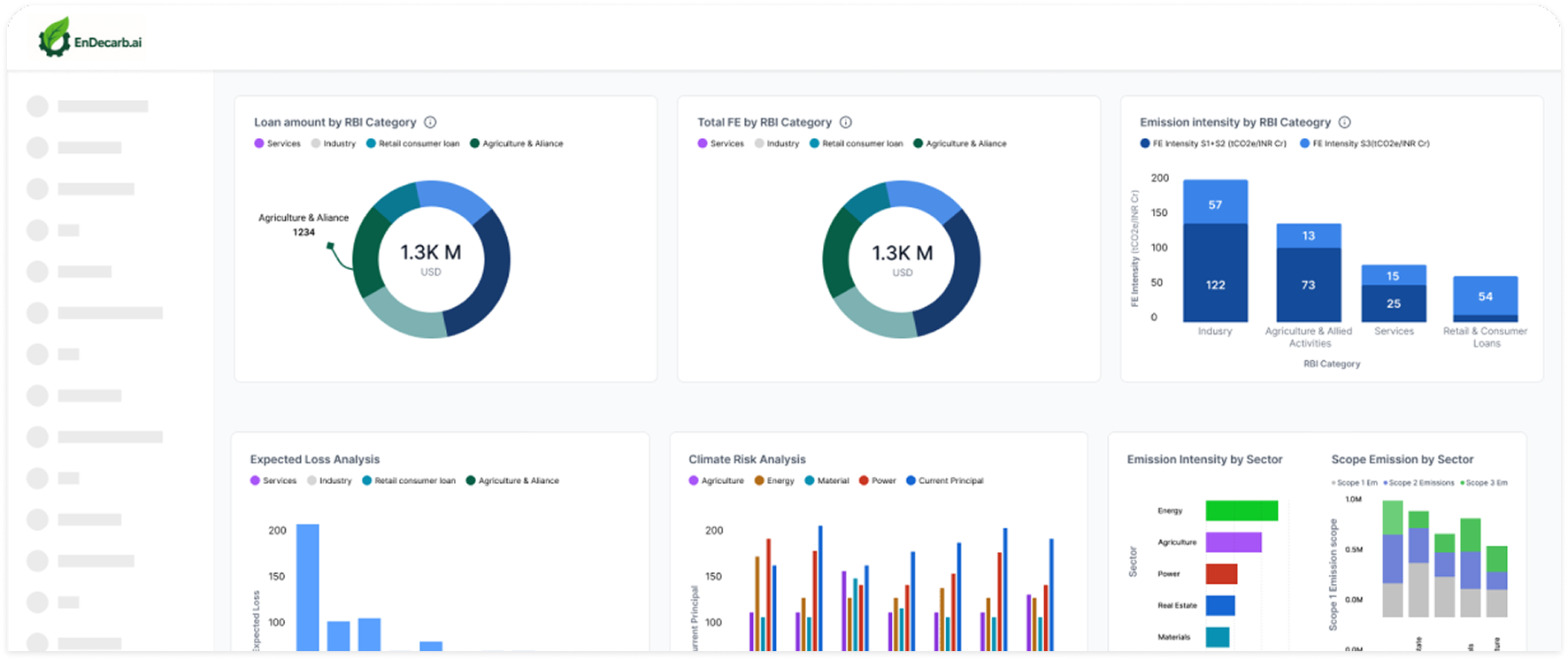

PCAF aligned financed emissions across all asset classes - Enterprise accuracy with full data quality score support

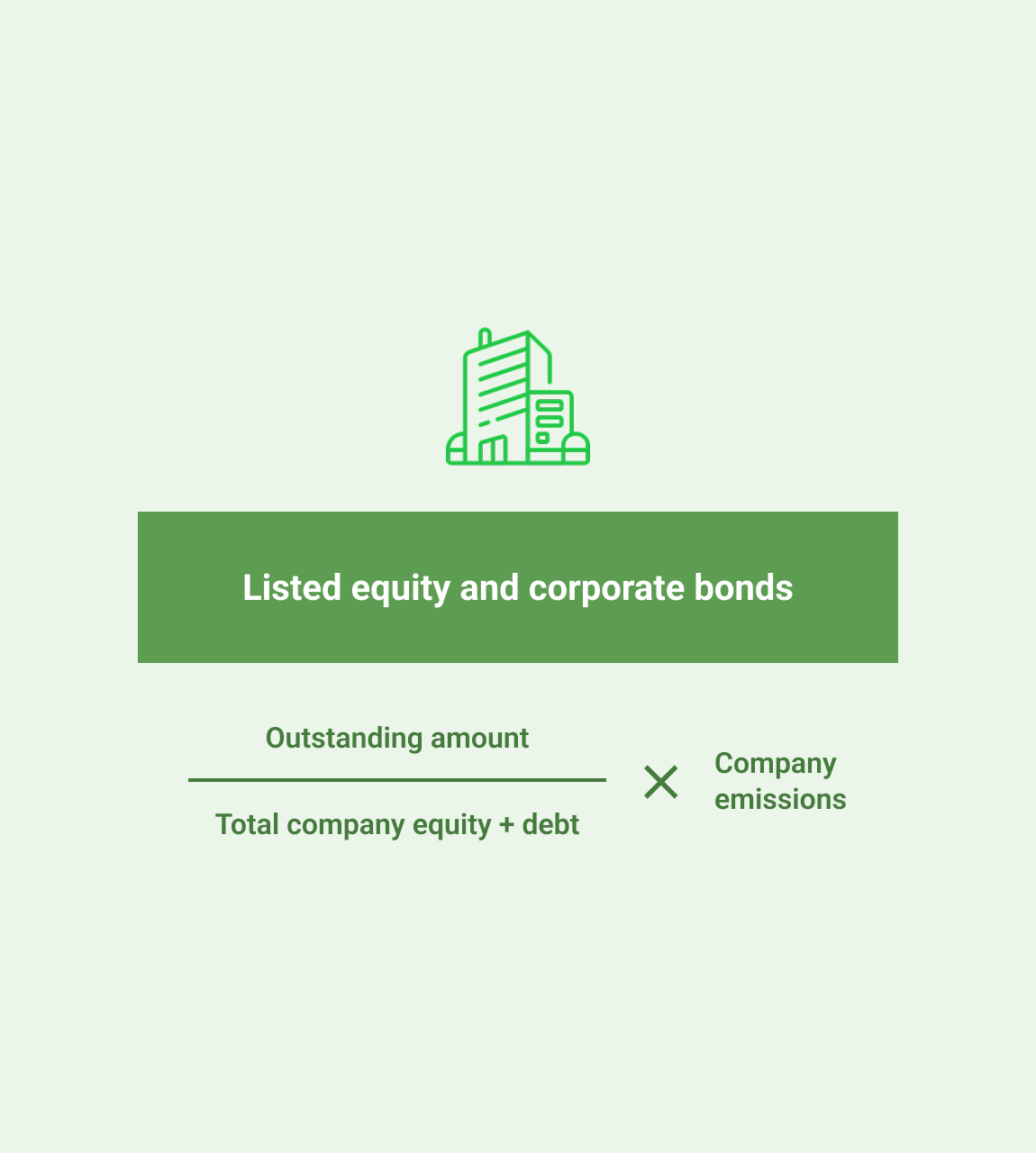

Financed emissions (also known as portfolio emissions) are the greenhouse gas (GHG) emissions that are attributable to financial institutions as a result of their lending, investment, and other financial services activities.

Often 90%+ of a financial institution’s carbon footprint lies in financed emissions (Scope 3, Category 15).

Standardized, transparent accounting across all asset classes ensures credibility and comparability.

Disclosure frameworks like TCFD, CSRD, and ISSB increasingly require financed-emissions reporting.

A core input for Scenario Analysis, Transition Risk Assessment, and Paris Agreement Alignment.

Identifies high-carbon assets and guides decarbonization strategies.

Fully aligned with the Global GHG Accounting & Reporting Standard across all asset classes.

Audit-ready outputs with complete support for data quality scores (Levels 1–5).

Built-in support for SBTi, Net Zero pathways, and Paris Agreement alignment.

Stress testing and scenario analysis to support Paris Agreement alignment and evolving climate policies.

Seamless integrations through SFTP, LMS, and enterprise systems to reduce manual work.

GHG accounting, financed emissions, climate risk modeling, and reporting in one integrated platform.

Frameworks like TCFD, CSRD, ISSB, and BSR built for seamless compliance.