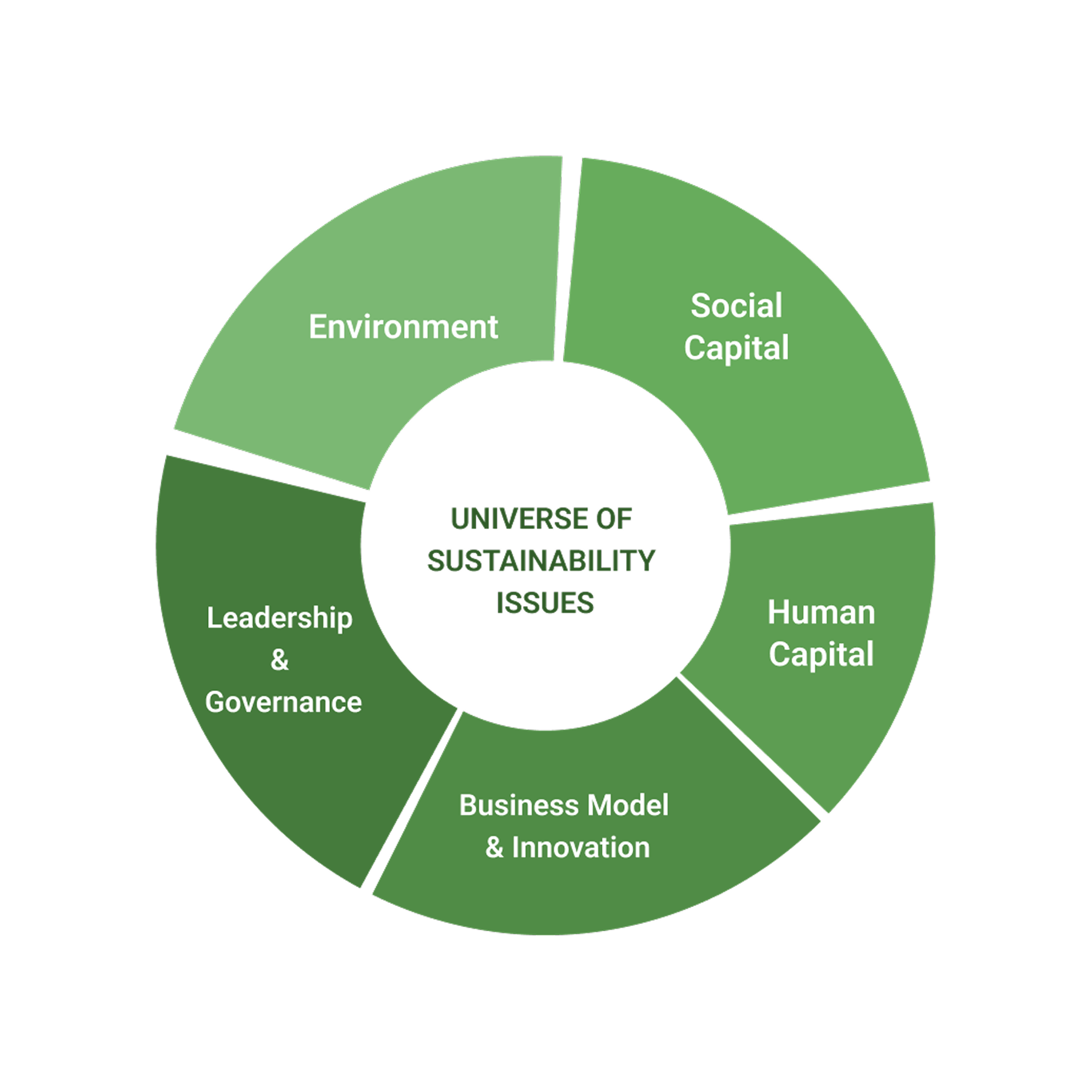

Reporting Frameworks

Explore our comprehensive suite of reporting frameworks designed to meet global sustainability and regulatory standards.

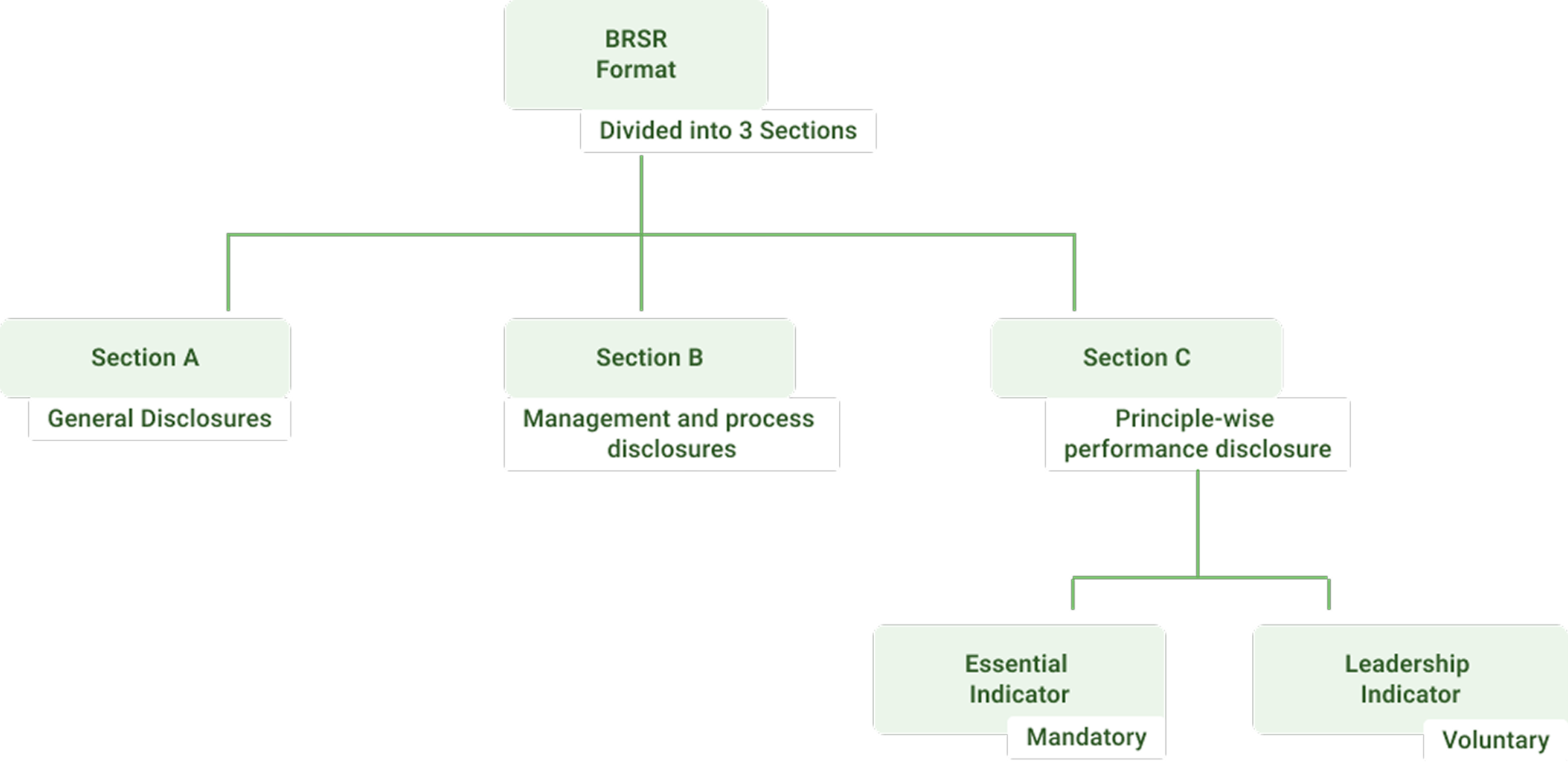

A mandatory disclosure framework for the top 1,000 listed companies in India, requiring businesses to report their performance on Environmental, Social, and Governance (ESG) parameters. It demonstrates a company’s commitment to responsible and sustainable business practices.

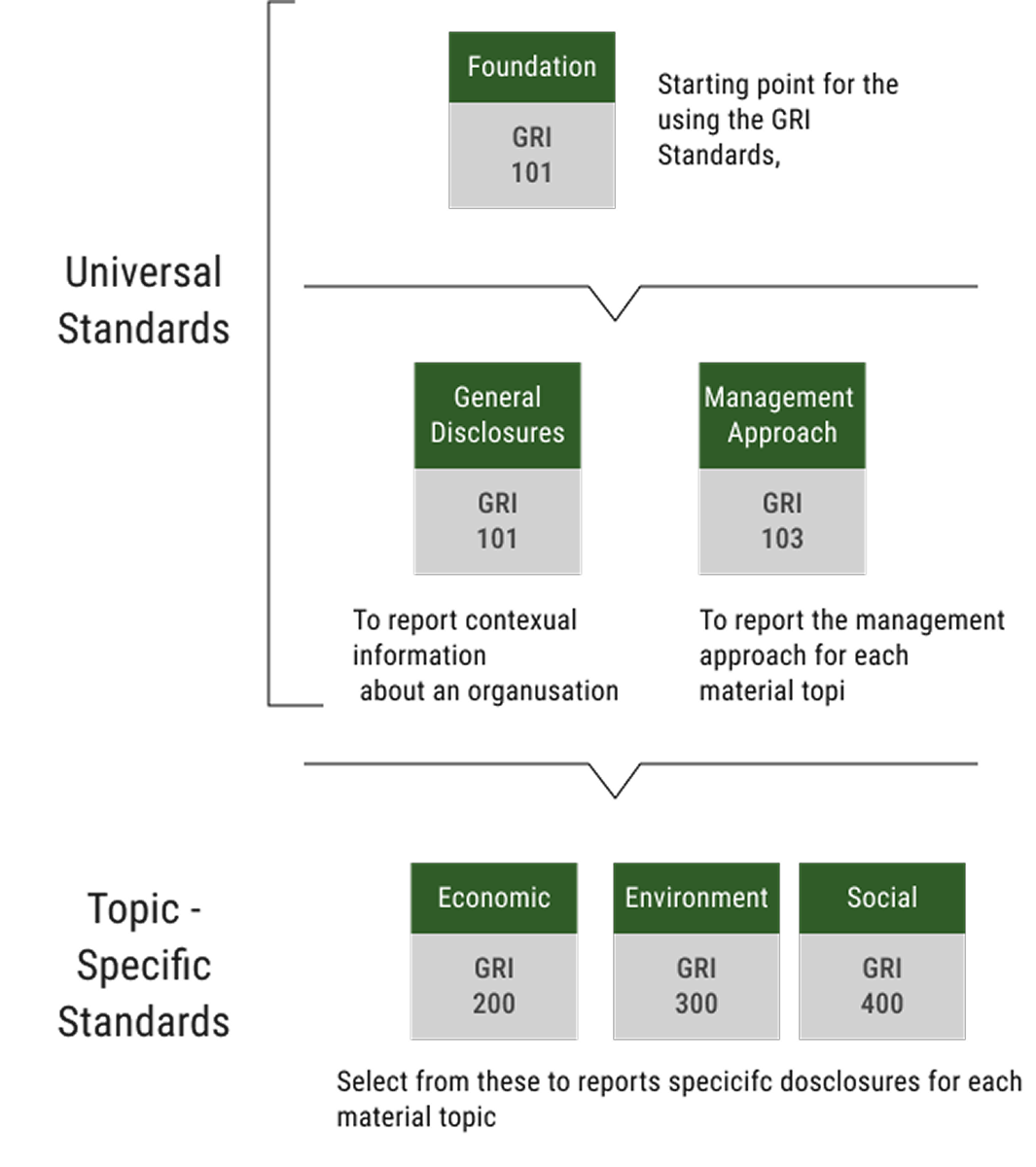

The world’s most widely adopted sustainability reporting standard, used by over 10,000 reporters across 100+ countries. Applicable to governments, corporations, and organizations of all sizes, GRI enables transparent disclosure of ESG impacts and performance.

Established by the Financial Stability Board in 2015, TCFD provides recommendations for consistent climate-related financial disclosures, focusing on governance, strategy, risk management, and metrics & targets. It enhances comparability and investor confidence.

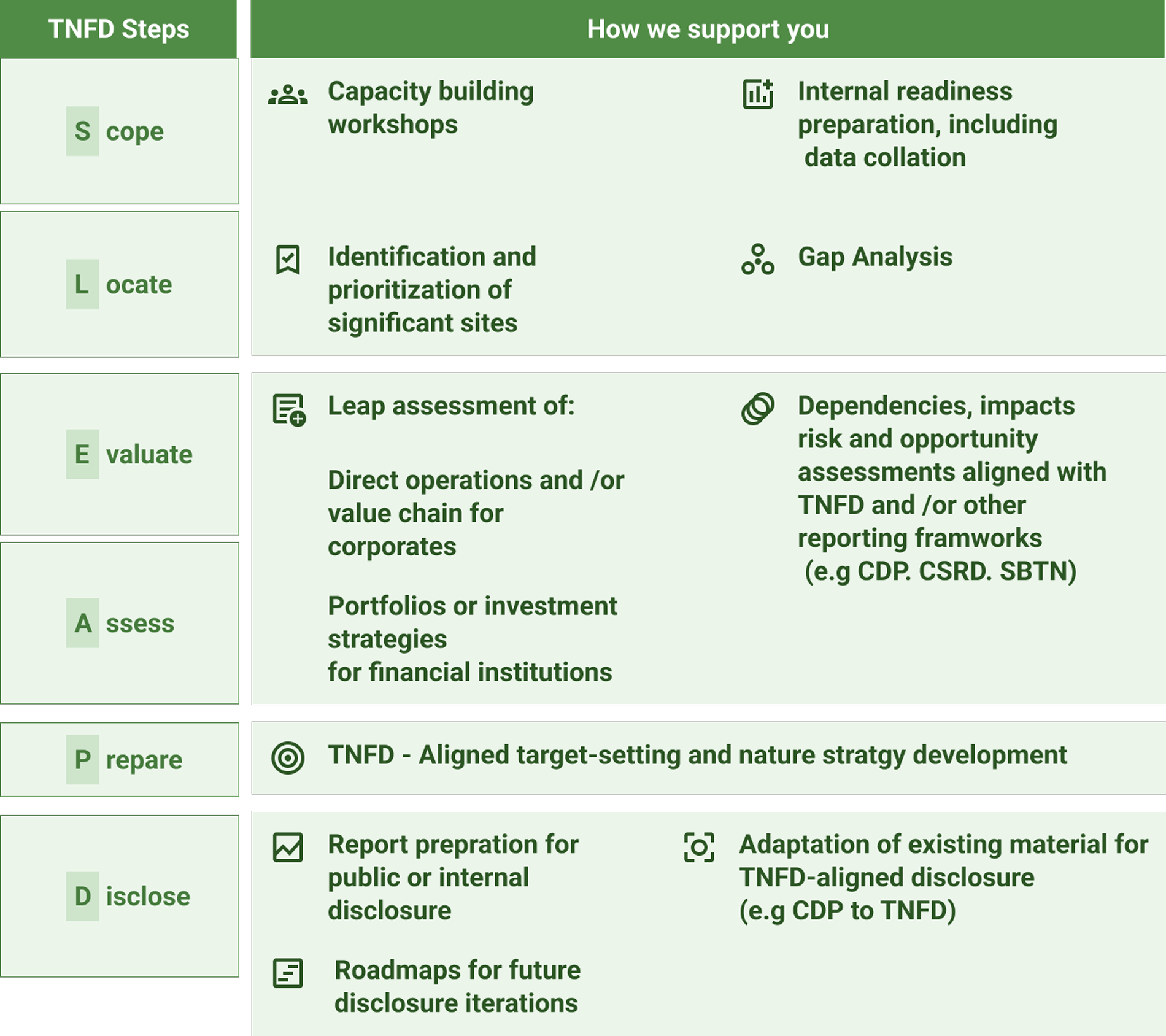

A global framework that guides businesses and financial institutions to assess, manage, and disclose nature-related dependencies, impacts, risks, and opportunities—supporting integration of biodiversity into decision-making.

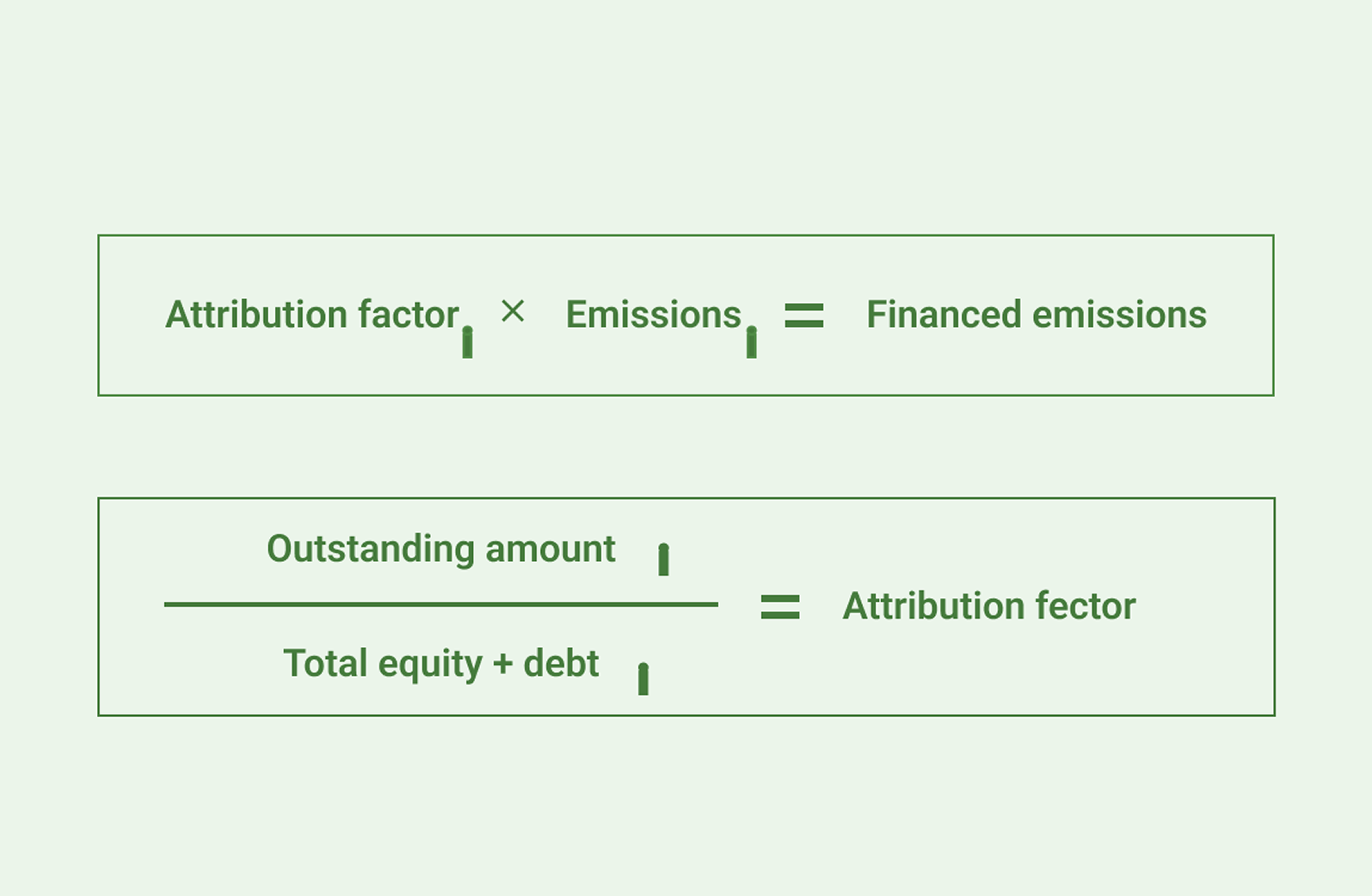

A global coalition of financial institutions developing a harmonized methodology for measuring and disclosing greenhouse gas (GHG) emissions associated with loans and investments, enabling transparency in financed emissions.

Develop a phased plan with milestones, responsibilities, and accountability measures.

The Reserve Bank of India’s Draft Disclosure Framework (2024) requires regulated entities (SCBs, AIFIs, NBFCs, UCBs) to disclose climate-related financial risks across governance, strategy, risk management, and metrics. Disclosures will be phased in from FY 2025-26 to FY 2028-29, ensuring transparency and resilience in India’s financial system.

SBTi enables companies to set and disclose science-based emissions reduction targets aligned with the Paris Agreement. Public reporting under SBTi demonstrates progress toward decarbonization pathways and enhances credibility with investors and stakeholders.

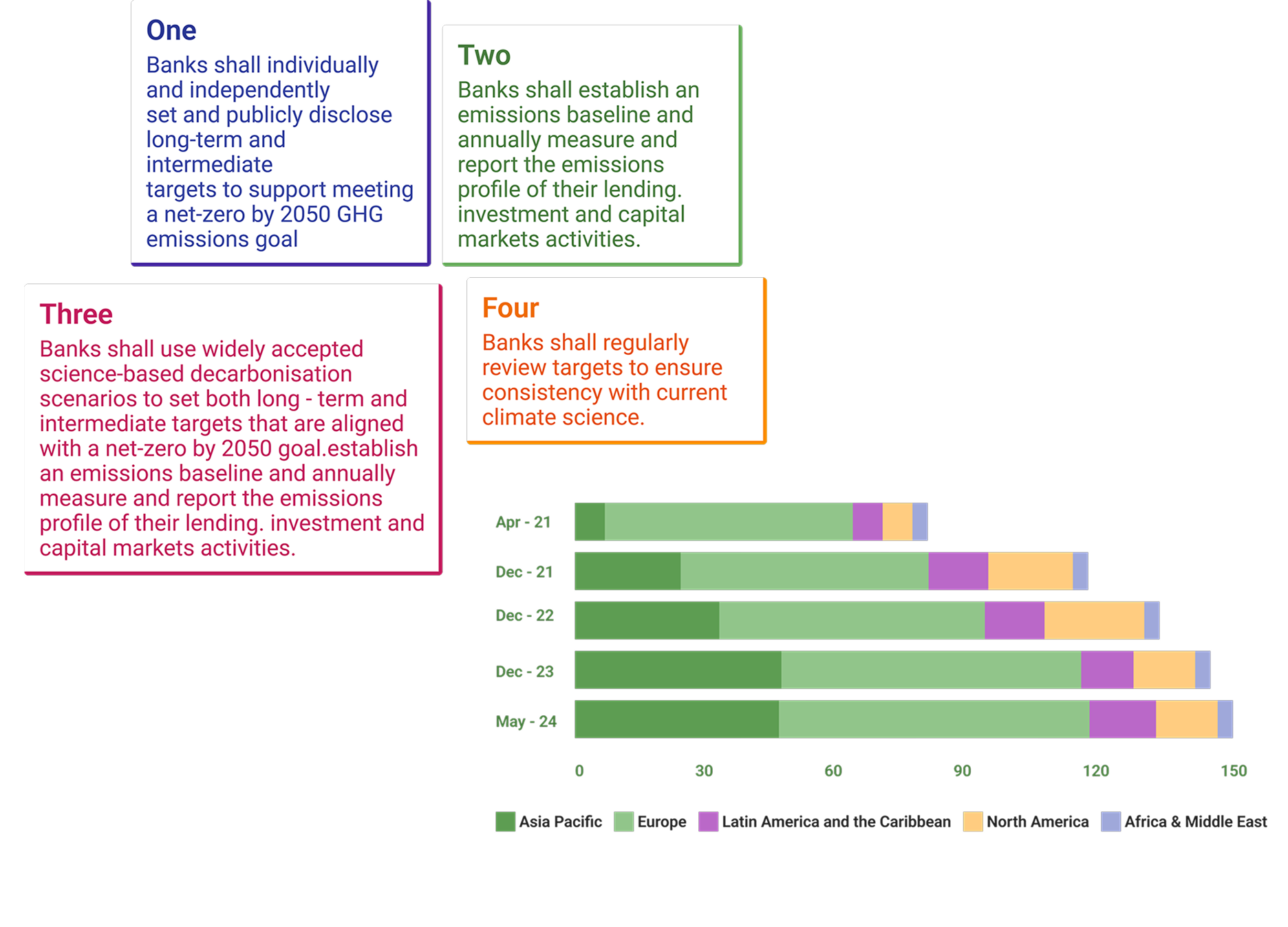

A UN-backed coalition of banks committed to aligning lending and investment portfolios with net-zero emissions by 2050. NZBA provides a unified framework for financial institutions to advance global net-zero goals through their financing activities.

A globally recognized certification that verifies businesses meet high standards of performance, accountability, and transparency. The B Impact Assessment evaluates companies across five dimensions: Governance, Workers, Community, Environment, and Customers.

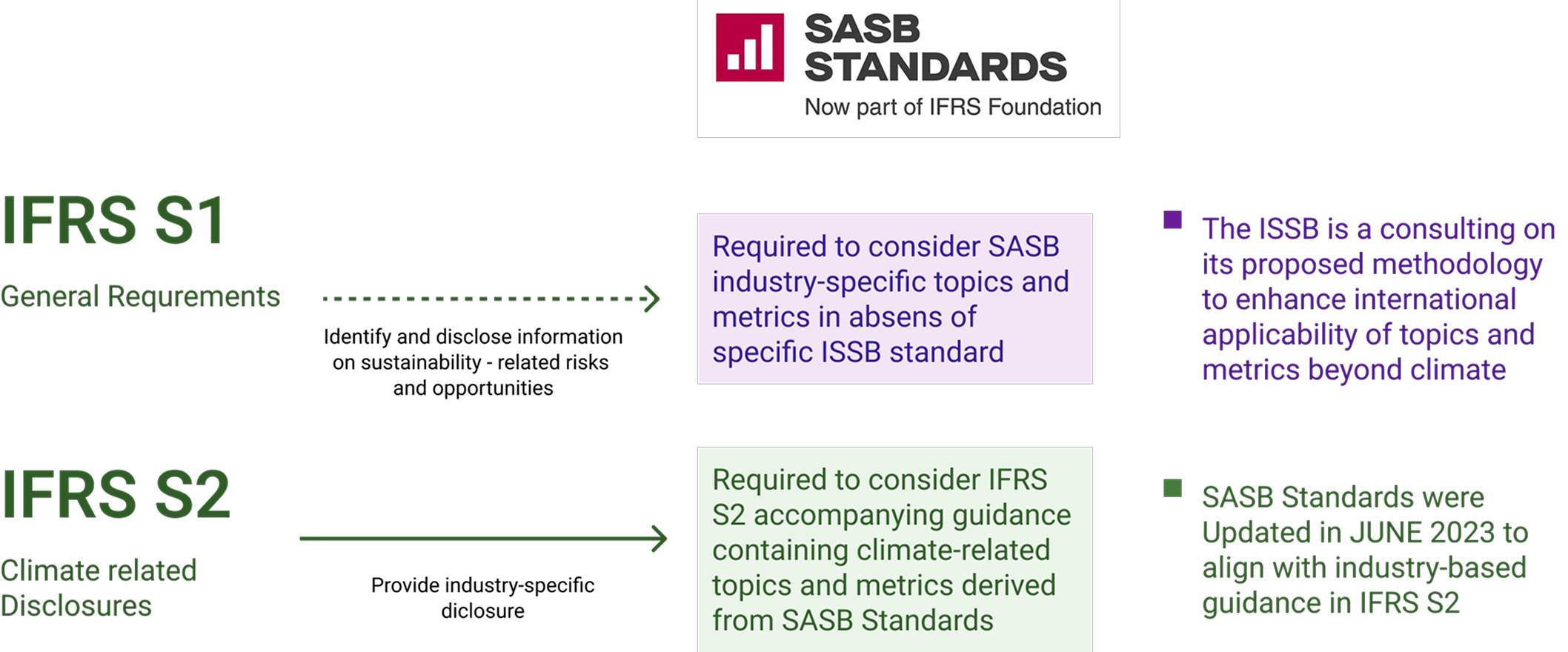

Issued by the International Sustainability Standards Board (ISSB), IFRS S1 requires disclosure of sustainability-related risks and opportunities relevant to investors. It establishes a global baseline for consistent and decision-useful reporting in financial filings.

Complementing IFRS S1, IFRS S2 requires disclosure of climate-related risks and opportunities that may affect an entity’s cash flows, access to finance, or cost of capital. It covers both physical risks (acute events and chronic shifts) and transition risks (associated with moving to a low-carbon economy).